Civil Engineering – Overview

Project-starts and main contract awards fell against the previous quarter and the 2022 levels. On the other hand, strong growth in detailed planning approvals provided a boost to the development pipeline.

Totalling £2.486bn, civil engineering work starting on-site during the three months to April decreased 17 per cent against the preceding three months and 27 per cent against the previous year. Major projects (£100m or more), totalling £1.181bn, were 33 per cent down on the preceding three months to stand 22 per cent lower than last year. Underlying project-starts (less than £100m in value) decreased 18 per cent against the preceding three months on a seasonally adjusted (SA) basis and were 31 per cent down compared with last year, totalling £1.305bn.

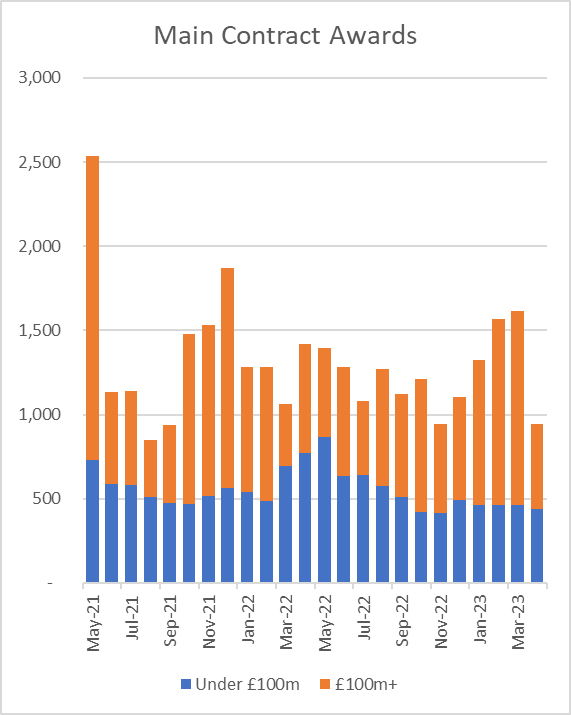

At £2.828bn, civil engineering main contract awards decreased 29 per cent during the period to stand 34 per cent down on the previous year. Major project contract awards, at £1.511bn, experienced a 42 per cent decrease on the preceding three months and 22 per cent against the previous year. Underlying contract awards, at £1.317bn didn’t fare as well, having experienced a 9 per cent decline against the preceding three months (SA) to stand 43 per cent down against the previous year.

Totalling £13.076bn, civil engineering detailed planning approvals more than quadrupled compared with the previous quarter to stand two times higher than a year ago. Major project approvals, at £11.798bn, increased six times against the preceding three months, more than doubled on the previous year. Underlying approvals also grew 22 per cent (SA) against the previous three months and were 33 per cent higher than a year ago, totalling £1.278bn.

Civil Engineering – Types of Projects Started

At £1.127bn, roads accounted for the greatest share (45 per cent) of civil engineering project-starts during the three months to April thanks to a 61 per cent increase on the previous year. Energy also performed relatively well, with project-starts experiencing a 49 per cent increase against the previous year to total £630m. The segment accounted for a 25 per cent share of starts. Harbour/ports project-starts increased 3 per cent against a year ago to total £173m, accounting for a 7 per cent share of the total value. The value of airport project-starts almost tripled to total £16m, a 1 per cent share of the sector.

In contrast, rail accounted for a 13 per cent share of the sector and slipped back 42 per cent compared with a year ago, totalling £333m. Water industry projects decreased 70 per cent with starts totalling £46m, accounting for 2 per cent of the sector. Waste projects starting on-site slipped back 97 per cent to total just £1m.

Civil Engineering – Regional

Most regions experienced a decline in civil engineering project-starts during the first quarter of 2023. However, the North West bucked the trend with the value of projects commencing on-site doubling against the previous year to total £624m. As a result, the region accounted for a quarter of starts during the period, the highest of any area. The growth was accelerated by the £300m Highways Term Maintenance project in Chester. The North East performed even better in terms of the growth rate. The value of starts almost tripled against the previous year to total £140m, a 6 per cent share of all civil engineering projects starting on-site.

The South East accounted for a 23 per cent share of the sector, making it the second most active region. However, the value of project-starts in the South East fell 11 per cent against the previous year to total £567m. Further decline was prevented by the £320m County Highways Network Maintenance project in Aylesbury. Scotland also had a weak period, with work commencing on-site decreasing 20 per cent compared to a year ago to total £390m, accounting for a 16 per cent share of sector project-starts. Further decline was prevented by the Carstairs Junction rail upgrade works worth £150m. London also experienced a 61 per cent decrease against the previous year, adding up to £162m, which accounted for 6 per cent of all civil engineering starts.

The South East, at £10.43bn , was by far the most active region for Civil Engineering planning approvals, with a share of 80 per cent. The value increased more than 50 times against the previous year, but this was solely because of the £10bnJunction 1 of M2 to M25 Lower Thames Crossing. Scotland grew almost five times against the previous year to total £970m, a 7 per cent share of the sector, making it the second most active region. The growth was boosted by the £750m Berwick Bank Wind Farm in Eyemouth.

The South West was also a strong region, with the value of approvals increasing 12 per cent compared with last year’s figures to total £513m, a 4 per cent share of the sector. At £428m, the North West quadrupled on a year ago, accounting for a 3 per cent share of the sector. The growth was accelerated by the £300m Darwen Energy Recovery Centre. In contrast, despite accounting for the same share, consents in the East of England fell 90 per cent on a year ago to total £335m.