Housing – Overview

Project-starts, detailed planning approvals and main contract awards all fell against the previous year. More positively, contract awards and approvals both grew on the preceding quarter thanks to an increase in major projects.

Totalling £8.312bn, residential work commencing on-site during the three months to April remained flat against the preceding three months to stand 39 per cent lower than a year ago. Major project-starts (£100m or more in value), at £1.993bn, decreased 2 per cent against the preceding three months and 20 per cent compared with the previous year. Underlying work starting on-site (less than £100m) totalled £6.319bn, an 18 per cent decrease against the preceding three months on a seasonally adjusted (SA) basis and 44 per cent down against the previous year.

Residential main contract awards increased 4 per cent against the preceding three-month period but stood 27 per cent down compared with the previous year to total £13.228bn. Underlying contract awards, at £11.737bn, decreased 1 per cent (SA) against the preceding three months and 19 per cent against the previous year. Major awards increased 31 per cent against the preceding three months but stood 58 per cent down against the previous year to total £1.491bn.

At £13.892bn, detailed planning approvals grew 20 per cent on the previous three months but slipped back 7 per cent against last year. Underlying approvals, totalling £9.940bn, decreased 8 per cent (SA) against the preceding three months and 22 per cent compared to the previous year. In contrast, major project approvals more than doubled against the preceding quarter to stand 79 per cent up against the previous year to total £3.952bn.

Housing – Types of Projects Started

Private housing accounted for 46 per cent of the total value of residential work starting on-site during the three months to April, with the value totalling £3,844m. Private housing starts fell 46 per cent against the previous year. Private apartment work starting on-site fell 25 per cent against last year to total £2,367m. The segment accounted for 29 per cent of project-starts during the period.

Social sector apartments (£1,203m) accounted for 14 per cent of the sector, remaining unchanged on a year ago, while social sector housing decreased 61 per cent to total £547m, a 7 per cent share of all housing starts. Student accommodation also weakened. At £62m, the value of project-starts in this segment fell 86 per cent. Totalling £159m, private sheltered housing fell 35 per cent on a year ago to account for 2 per cent of the sector. In contrast, social sector sheltered housing almost tripled compared with last year’s levels to total £117m, a 1 per cent share of the sector.

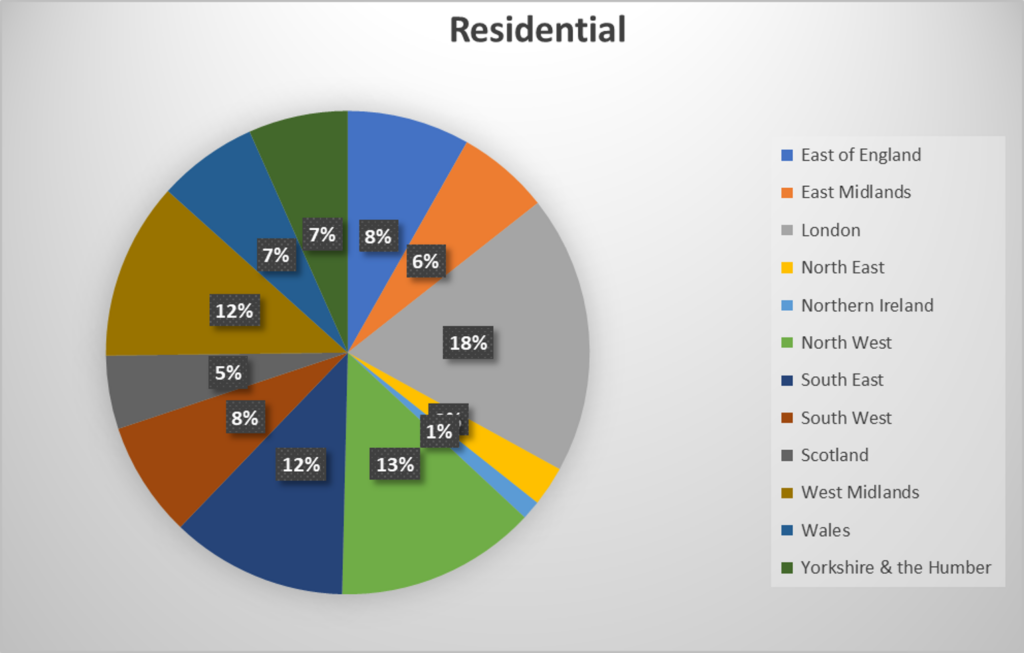

Housing – Regional

The three months to April was a weak period for all regions in the UK. London accounted for the greatest proportion (18 per cent) of residential work during the period, totalling £1.549bn, despite experiencing a 53 per cent decrease compared with the previous year’s levels. At £1.117bn, the North West was the second most active region, accounting for a 13 per cent share of project-starts. The region experienced the smallest decline at 2 per cent on the preceding year, boosted by the £400m 1,202-unit Gould Street Development in Manchester.

Accounting for 12 per cent each, the South East (£980m) and the West Midlands (£958m) endured a slump of 53 per cent and 30 per cent against the previous year respectively. Project-starts in the West Midlands included the £302m 722-unit Great Charles Street development in Birmingham. The East of England (£681m) and the South West (£642m) fell 39 per cent and 16 per cent against the previous year respectively, to account for 8 per cent of the sector each. Northern Ireland faced the steepest decline at 67 per cent against the previous year, bringing its total value down to £106m, a 1 per cent share of the residential sector.

Like project-starts, London was also the most active region for detailed planning approvals, totalling £2.289bn, a 17 per cent share of the sector. However, the value of approvals in the capital slipped back 32 per cent against the previous year. Housing consents in London included a £600m 868-unit development in Southall. The South East also experienced a weak period with approvals falling 12 per cent against 2022 levels to total £1.442bn, a tenth of all consents in the housing sector. In contrast, Scotland also accounted for 10 per cent, with the value of approvals in the region increasing 7 per cent on a year ago to total £1.357bn.

Totalling £1.833bn Yorkshire & the Humber also performed well. The value of detailed planning approvals jumped 67 per cent to account for 13 per cent of the sector, making it the second most active region, having been boosted by the £500m 1,350-unit Sweet Street West Development, and the £400m Urbanite Living student accommodation project in Leeds. The East of England accounted for 11 per cent of consents in the three months to April, having grown 9 per cent against the previous year to total £1.561bn. The West Midlands accounted for 9 per cent of project approvals, having climbed 6 per cent against the previous year to total £1.228bn.