Community & Amenity – Overview

Project-starts, main contract awards and detailed planning approvals all fell against both last year and the previous quarter.

Community & amenity work starting on-site totalled £234m during the three months to April, a 75 per cent decrease compared with the preceding three months and 58 per cent down on the previous year. Unlike the previous quarter and a year ago, there were no major project-starts (£100m or more). Underlying project-starts (less than £100m in value) fell 23 per cent against the preceding three months on a seasonally adjusted (SA) basis to stand 41 per cent down against last year’s levels.

Community & amenity main contract awards, totalling £235m, experienced a 22 per cent decrease against the preceding three months to stand 61 per cent down on the previous year. Underlying contract awards also performed poorly, declining 36 per cent against the preceding three months (SA) to stand 49 per cent down on 2022 levels. No major projects reached the contract awarded stage, remaining unchanged against the preceding three months but down on previous year.

Detailed planning approvals slipped back 64 per cent against the previous three months to stand 31 per cent down against a year earlier and total £269m. Similarly to project-starts and main contract awards, there were no major approvals in contrast with the preceding quarter and last year. Underlying project approvals fell 22 per cent (SA) on the previous three months and 2 per cent against a year ago to total.

Community & Amenity – Types of Projects Started

Totalling £68m, local facilities were the segment with the highest proportion (29 per cent) of community & amenity project-starts. The value of local facility project-starts fell 35 per cent.

Blue light projects worth £58m started on-site during the three months to April, 48 per cent lower than the same period last year, to account for a quarter of sector starts. Government buildings, totalling £48m, also slipped back 80 per cent compared with last year, accounting for 20 per cent of the sector.

Military accounted for 5 per cent, having dropped 70 per cent on a year ago to total £8m. Places of worship experienced the sharpest decline, slipping back 94 per cent to total £1m, a 1 per cent share of the sector. Prisons were the only segment experiencing growth during the period, adding up to £51m having doubled compared with last year to account for 22 per cent.

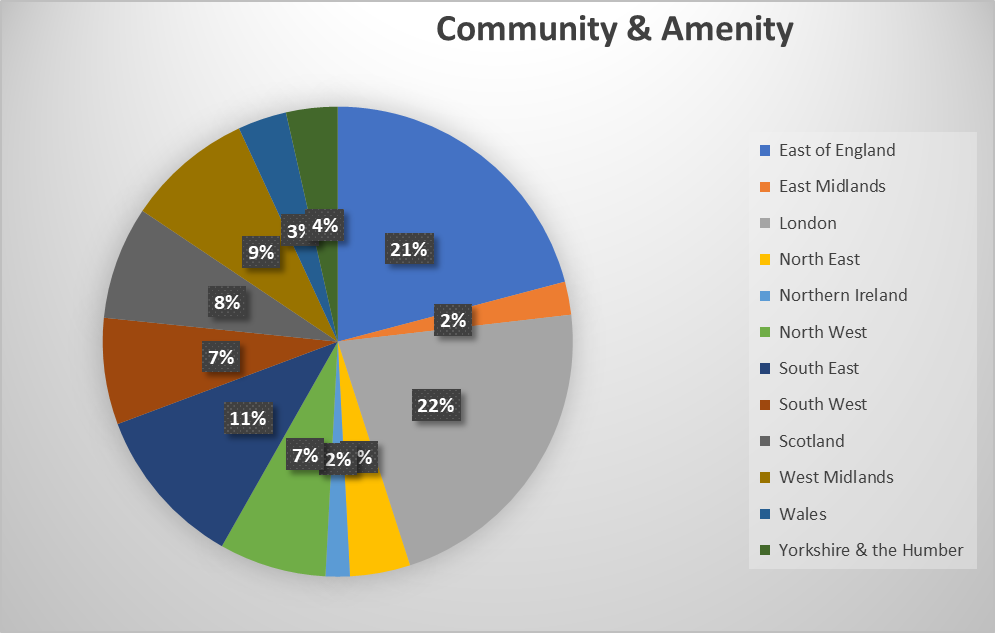

Community & Amenity – Regional

London dominated community & amenity starts, accounting for 22 per cent of work starting on-site, although at £51m this is 78 per cent lower than a year ago. Further decline in the Capital was prevented by a £22.89m government office project in Westminster. The South East accounted for 11 per cent of sector starts and decreased 63 per cent against the previous year to total £26m. At £18m and accounting for 8 per cent of sector starts, Scotland also experienced an 81 per cent slump against the preceding year. Northern Ireland experienced the steepest decrease at 84 per cent compared with last year’s levels, bringing the total value down to £4m. As a result, project-starts in the region only accounted for a 2 per cent share.

On the other hand, project-starts in the East of England more than doubled against the previous year to total £49m, a 21 per cent share of starts, making it the second most active region. The West Midlands also grew almost seven times on last year’s levels, to account for 9 per cent of the sector, totalling £20m. The growth was solely due to the commencement of an £18m emergency serviced hub building in Redditch.

At £52m, Yorkshire & the Humber dominated Community & Amenity detailed planning approvals. Accounting for a 19 per cent of the sector, the value of approvals jumped 55 per cent against the previous year, boosted by the approval of the £16.84m Scargill House, Kettlewell project in Skipton. Totalling £32m, approvals in London quadrupled against the previous year, accounting for a 12 per cent share of the sector. Northern Ireland also performed relatively well, having almost tripled on the preceding year’s levels to total £25m and accounting for 9 per cent of sector approvals. This growth was mainly due to the approval of the £18m Roselawn Crematorium in Belfast. The North West doubled on 2022 levels to total £21m, an 8 per cent share of community & amenity consents.

In contrast, approvals in the South West slipped back 17 per cent against the previous year to total £38m, a 14 per cent share of the sector, despite it being the second most active region. Approvals in the South East were also 22 per cent behind compared with the previous year, totalling £30m and accounting for 11 per cent of all approvals. At £1m, Wales experienced the steepest decline, having fallen 95 per cent on a year ago.