Sri test

Construction project-starts showing signs of recovery

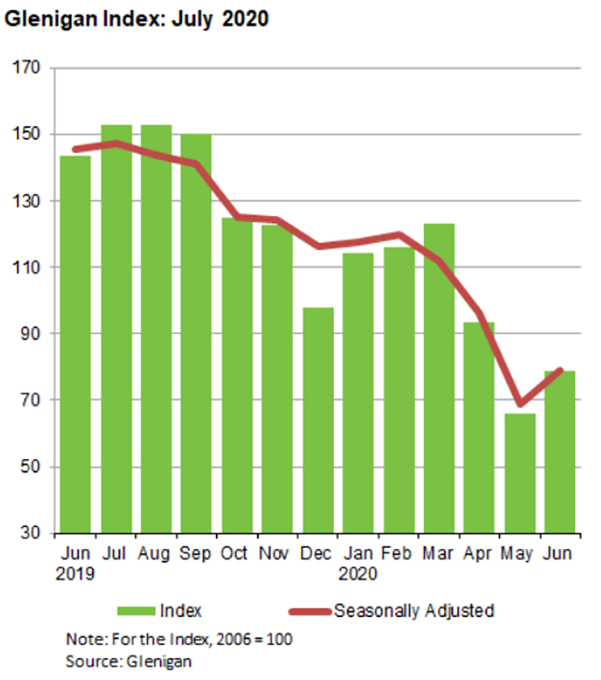

– Total construction starts were 45% lower than a year ago and 29% lower than the preceding quarter on a seasonally adjusted basis during the three months to June.

– Residential starts declined 46% on the previous year and 29% against the preceding three months on a seasonally adjusted basis.

– Non-residential starts saw the sharpest fall during the three months to June, falling 50% on a year ago and 37% against the preceding quarter.

– Civil engineering project starts were 21% lower than a year ago, starts were unchanged against the preceding three months.

Rhys Gadsby, Glenigan’s Economic Analyst, commented on this month’s figures: “The value of new projects commencing on-site is still sharply down on the previous year. The latest Glenigan Index shows a 45% fall in the value of starts during the three months to June against a year ago. This decline was largely due to the lockdown impacting starts in May. However, when looking at June alone, the value of starts began to recover. The value of work commencing on-site in June was just 15% lower than the previous year, a very welcome improvement on May’s performance.

With lockdown restrictions easing further at the beginning of July, this may encourage more work in the development pipeline to proceed to site.”

All sectors still down

The value of project-starts in the residential sector fell sharply during the three months to June against the previous year, with most major housebuilders shutting sites during the period.

Social housing projects-starts fell the sharpest within the residential sector, being 51% down on the previous year and 30% down compared to the preceding quarter on a seasonally adjusted basis.

Private housing starts also suffered during the three months to June, falling by 43% compared to the previous year and by 29% compared to the preceding quarter (seasonally adjusted).

Non-residential project-starts fell the sharpest during the second quarter. Against the previous year, starts fell by 50%, and 37% compared to the preceding quarter on a seasonally adjusted basis.

Unsurprisingly, every sector within non-residential experienced a fall in the value of starts against the previous year.

Hotel & Leisure starts fell particularly sharply, falling 60% against the previous year and against the preceding quarter on a seasonally adjusted basis.

Education was another sector which saw the value of project starts fall steeply during the second quarter. Starts fell 59% compared to a year ago and by 46% compared to the preceding three months (seasonally adjusted).

Health experienced the smallest drop in the value of starts against the previous year during the second quarter, falling 37%. Against the preceding quarter on a seasonally adjusted basis, starts fell 40%.

Offices saw the smallest fall in starts against the preceding quarter, falling 9% (seasonally adjusted). However, office starts fell 38% against the previous year.

During the second quarter, civil engineering starts were down by 21% compared to the previous year and unchanged on the preceding three months on a seasonally adjusted basis.

Infrastructure starts were down by a quarter against the previous year, and were unchanged on the preceding three months on a seasonally adjusted basis during the second quarter.

The value of work commencing on-site within the utilities sector was 14% lower than the previous year. However, utilities was the only sector to achieve growth against the preceding quarter (seasonally adjusted), climbing 2%.

All regions yet to recover

Unsurprisingly, every region across the UK suffered heavily during the second quarter in terms of starts.

The sharpest falls came from the North East and Scotland. The value of starts in the North East were 62% down on the previous year. Scotland imposed tight restrictions on construction sites during the lockdown period, so it is unsurprising to see the value of starts fall heavily in the country, falling 61% against the previous year.

Starts also fell steeply in Northern Ireland and Yorkshire & the Humber, with both areas seeing the value of starts fall 49% compared to a year ago.

Wales and the North West fared the best out of all the regions during the second quarter, despite the value of starts falling 26% and 29% respectively against the previous year.

Glenigan Indices (underlying* projects up to £100 million)

| Glenigan Index | Residential | Non-residential | Civil engineering | |||||

| Index | % Change | Index | % Change | Index | % Change | Index | % Change | |

| Jun-19 | 143.4 | 5% | 182 | 9% | 119 | 0% | 128 | 9% |

| Jul-19 | 152.9 | 7% | 194 | 9% | 125 | 4% | 150 | 12% |

| Aug-19 | 152.8 | 6% | 198 | 8% | 125 | 1% | 134 | 12% |

| Sep-19 | 150.1 | 4% | 195 | 9% | 122 | -8% | 133 | 44% |

| Oct-19 | 124.7 | -12% | 153 | -11% | 110 | -18% | 101 | 30% |

| Nov-19 | 122.7 | -14% | 140 | -17% | 111 | -16% | 122 | 18% |

| Dec-19 | 98.0 | -20% | 113 | -25% | 89 | -18% | 92 | -3% |

| Jan-20 | 114.4 | -13% | 130 | -19% | 104 | -5% | 113 | -19% |

| Feb-20 | 116.1 | -13% | 137 | -16% | 103 | -5% | 111 | -28% |

| Mar-20 | 123.3 | -20% | 143 | -18% | 106 | -18% | 136 | -29% |

| Apr-20 | 93.7 | -35% | 110 | -37% | 75 | -37% | 123 | -20% |

| May-20 | 66.1 | -53% | 74 | -57% | 50 | -57% | 113 | -20% |

| Jun-20 | 78.8 | -45% | 99 | -46% | 59 | -50% | 101 | -21% |